The State of Our “Union” after a Bruising Election, Year & Decade

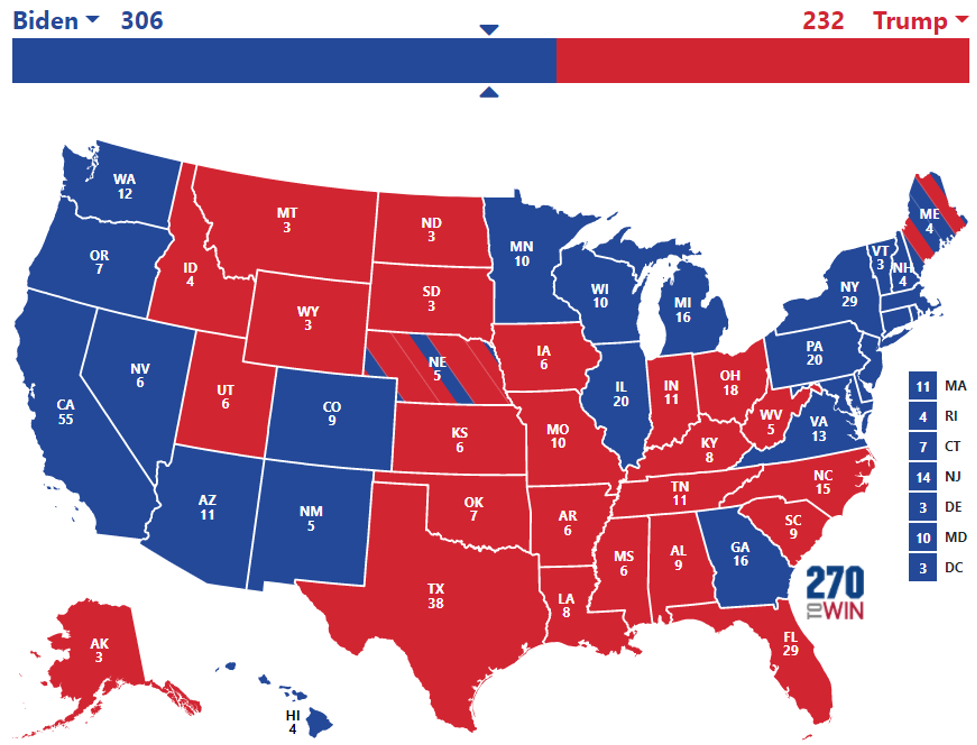

Right now, former Vice President Joe Biden is on track to win the 2020 Presidential election. The final certifications started coming in as of November 18, but as things stand now, Biden has 306 electoral votes, compared to President Trump’s 232 (a perfect mirror of 2016’s Presidential election results).

Biden has 51.1% of the national vote versus 47.2% for Trump. Biden has 79.7 million of the popular vote versus ~73.7 million for Trump — a substantial 6.0 million vote differential. Biden has received the most votes of any Presidential candidate ever, but Trump received the second most ever — more than either he or Hillary Clinton received in 2016.

Beyond the Raw Numbers

The traditional way of looking at voter distribution is by state, and the traditional conception of voting is that the coastal states are blue, and the central states are red. California and New York are Democratic strongholds; Texas through the Dakotas are Republican strongholds.

In this election, Biden flipped Wisconsin, Michigan, and Pennsylvania (the “Blue Wall”) back to the Democratic side, and also won Arizona for only the second time for Democrats in 50 years, and Georgia for the first time since the 1990s.

But let’s look at the vote at the county level. Here, the vote is a lot more diffuse. I affectionately call it “the sea of red sauce with blueberries dotted on top.” What we see is that, in fact, states are not monolithic. States like Texas have a fair amount of democratic voting, and states like New York have a fair amount of Republican voting.

When we go further in, looking at it from a population level, we see something remarkable. First off, a good chunk of the country from California to the Mississippi River is more or less vacant territory — nothing but prairies, cattle, and skiers. Where the Democrats won was in the cities: Seattle, Portland, San Francisco, Los Angeles, San Diego, Phoenix, Scottsdale; also, very importantly, Houston, Austin, Dallas, Omaha, Chicago, Detroit, Miami, New York, Boston, Washington D.C.

Republicans won in all the rural counties. In Pennsylvania, Biden won Pittsburgh and Philadelphia, and Trump won pretty much everything in between. This is very important to understand: Our conflicts are not a conflict between red states and blue states. It’s a conflict between rural America and urban America, between rural Republicans and Democratic city folk. The rural Republicans depend on the city folk for healthcare, technology, education, and entertainment. Urban Democratic folks depend on the rural folks for FOOD!

We have got to find a way to get along. We need each other — we need each other very badly.

A House Divided

From this election, we also learned that while many Americans didn’t like Trump, they didn’t like Democrats even more. Trump claims that that the Democrats have stolen the election, that it was rigged. Well if it really was rigged, why didn’t the Democrats rig it to pick off Joanie Ernst in Iowa and Susan Collins in Maine at the same time? Why not pick up one or two seats in Georgia, another seat in North Carolina? If they “rigged” it, why not really rig it, to control the Senate?

Trump may have lost the Presidency, but the “Blue Wave” did not happen. Even after the Georgia run-offs on January 5, Republicans are likely to control the Senate, and the Democrats will have lost at least 5 seats in Congress and made no gains on the state level.

What that means is, whereas other presidents — Clinton in ’92, Bush in ’00, Obama in ’08 — came in with full control of the executive and legislative branches and could do as they wished for their first two years, Biden is arriving with a divided government, and will have to govern primarily through executive order. That means that any progressive plans to expand healthcare, protect the environment, regulate monopolies, and most importantly provide a recession stimulus aren’t likely to happen.

The Economy — Good News and Bad News

The Fed announced that rates will be flat or near zero through 2023. The world economy is picking up faster than the U.S. economy because everybody else in the world is doing better with coronavirus than we are. When you invest in the S&P 500, you’re not investing in the U.S. economy, you’re investing in the world economy, so most of what we’re seeing so far is good news for American companies. Stock prices hit a record on September 3rd, fell 10% by the end of September, rallied in October, and now they’re at record levels again.

We expect stocks to be volatile over the next 12 months as vaccine news develops — optimism over vaccine announcement buoys it, and pessimism about vaccine efficacy drags it. That will be uncomfortable, but in general, we expect stocks to be higher a year from now. By then, we’ll likely have taken tangible steps to recover from the pandemic, the economy will start to recover slowly, and earnings will rise as a result.

We’re starting to scale cash reserves back into stocks, and we’ll continue to do this through December and January. The only caveat is that if a client needs money for a house reconstruction or a big purchase of some kind, we’re keeping that in cash, not putting it in stocks.

But good news for the stock market is not good news for average Americans. There are still 10 million fewer Americans working today than in January of this year. The U.S. response to the pandemic is the still worst in the world. Daily mortality is up 75% over the last month to 2,000/day, and it will continue to soar through Thanksgiving, into Christmas, because the infection rate is triple what it was back in June.

The infection rate in South Dakota is 10 times what it is in New York City, where everybody lives on top of everybody else. Grocery stores are crowded, subways are crowded, streets are crowded; in the Dakotas, meanwhile, people are enormously spread out, and scarce — it’s the least populous region in the country. How can they be getting infected at such a high rate?

Oh yeah, they don’t believe in masks. It’s real simple.

We also still see farm bankruptcies and small business failures rising rapidly. Food insecurity is high — there are huge lines to get basic groceries in places like Texas. Risk of foreclosure and eviction are both rising. In short, it’s shaping up to be one of the ugliest winters that any of us can remember.

The biggest problem of all is that if we’re fighting each other, we’re not solving our problems.

There was a big rally recently in Washington D.C., where MAGA-clad masses chanted, “Stop the steal! Stop the steal! Stop the steal!” There is literally no evidence whatsoever from 50 states, plus the Department of Homeland Security, that there was any fraud, vote stealing, vote tampering — nothing. But if you live in the right-wing media universe, “It was stolen, it was stolen, it was stolen.” Trump’s flunkies, most hilariously Rudy Giuliani contain to pitch a baseless narrative of massive and universal fraud. If it wasn’t so stupid, we should be genuinely alarmed by this attempted coup FROM the White House. We need to get back to the reality-based economy, and away from the fantasy-based economy.

The Chinese Century

Trump was supposed to be the infrastructure president. He was “The Builder.” He was supposed to invest $10 trillion over 10 years on airports, highways, bridges, ports, and railroads. We haven’t spent any of it so far, and we’re not likely to spend any of it in his remaining weeks in office.

The Chinese, on the other hand, are spending $1 trillion per year. Not per decade, per year, within China and across the world, building relationships. The U.S. left the Trans-Pacific Partnership (TPP) a couple years ago. Meanwhile, China just inked a deal on a new trade pact (the Regional Comprehensive Economic Partnership) where they’re the center of a region spanning Pacific Rim 15 countries (including Japans, South Korea, Australia and New Zealand) and 2.2 billion people, BUT the United States is excluded.

China was labeled as the world’s largest economy by the IMF in October and will grow 8% next year. We’ll be lucky to grow at all next year.

In 1920, the U.S. became the largest economy in the world. In 1945, the U.S. had 4% of the world’s population and accounted for 25% of world GDP. That era is now over. We’re #2, and the century to come will be known as the Chinese century.

What We Need, but May Not Get

Just to get through 2021, we need to spend $2-$4 trillion to support businesses, support household income, and support state and local governments that are pretty much bankrupt at this point. If we don’t, states will ll start laying off social workers, firemen, police officers, doctors, nurses, and flood the unemployment rolls. Avoiding that outcome is dependent on Congress and the White House signing a stimulus bill.

Different bills have been kicking around since June, and hasn’t been signed yet. I’m skeptical if, with a split Congress, we’ll ever get one. If we don’t, the recession we’re in now will drag on through 2021, and possibly into 2022.

The U.S. stock market usually reflects the state of the world economy, not the U.S. economy, but eventually, a dragging U.S. economy WILL drag down the U.S. stock market.

This is where it could cost us personally. Through 2008, the U.S. economy was growing at a pretty robust rate, and we could pay out retirement benefits to our clients at a 6% draw rate on their portfolios. For every million dollars they had in assets, we could send them $60,000 per year in retirement draw. We lowered that to 5% a year after 2009 because the economy went into a slower mode, and we may have to lower that again to 4.5% or even 4% if we can’t get past this partisan BS, move in a new direction, and get the economy rumbling again.

There’s a level where the economy can grow comfortably without inflation — 3% a year. We’ve been growing at about 2.2-2.5% per year over the last 10 years. We’re not growing at our maximum capacity, and that hurts wealth creation.

Generation Gig

For most of my clients, a lot of this doesn’t matter. They’ve had good careers, their houses are paid for, they’re retired or close to it — things are pretty good. But for the children and grandchildren of our clients, things look bleak.

I graduated from college in 1983 in the midst of a terrible recession, and I spent my first six months after graduation bartending and tutoring. But after those six months, I got a management-track job at Morgan Stanley that set me on a path to buying an apartment, getting engaged, getting married, starting a family, going to grad school, starting a business, and putting two kids through college.

Most of my peers had similar experiences. Yeah, it was hard at first, but then it got pretty easy after that.

When I look at the current generation — the children and grandchildren of my clients — about 15% of those twenty-somethings have career-track jobs with training, healthcare and retirement benefits. The rest are in gig economy jobs on a per-hour basis with no benefits, no training, and no career path. Many of them are still living at home in their mid-twenties. By the way, those kids are the lucky kids. They were the ones who got to go to the best U.S. colleges and universities and graduated without student loans.

How can we have an economy if people can’t even get to the basics of household formation, let alone develop some real substantial wealth? As entry level jobs disappear even in white collar professions, young people can’t acquire the skills to move to higher paying jobs. It’s like the first rung on the career ladder is 40’ over their heads. I don’t know how to turn this around. The situation didn’t start yesterday, it’s been the trend for a while, and the pandemic has only made e barriers worse.

Cautiously Pessimistic

We’ve been heading in the wrong direction as a nation for the past 10, 20, even 30 years. When I say 30 years, it’s because it was during the Clinton administration that we began shipping blue-collar, working-class jobs overseas in a big way, brought in automation, and hollowed out the jobs that people without college educations could get.

That accounts for most of the anger that exists right now between red America and blue America. The single biggest divide is between those who do have a college education, and those who don’t. If you do, you can get a good job in information technology or in the service economy. If you don’t, you could be a truck driver, or work in the distribution center for Amazon. But putting together computers, washing machines, and cars; those jobs have been automated or exported. There’s no opportunity there.

Our hope is that the new Biden/Harris administration can turn the situation around, and rebuild the economy, just as the Obama/Biden administration rebuilt the economy in 2009 after the last Republican administration blew things up. But our fear is that the partisanship in Washington will throttle that effort in the crib. We’re happy that Biden won, frankly, but we’re not super optimistic about how things will be going over the next year or two.

Two reasons for better times ahead:

Professionals return to the White House starting January 21st.

The pandemic will diminish in the second half of 2021, recede in the rear view mirror by 2022.

Until then, socially distance, wear a mask, etc.